Money is Time

An impractical but deep truth

Time is money… or so the saying goes.

But what if, the saying has it backwards? Not because it is wrong, as this truth is both practical or insightful. But, there is an issue with a framing that subtly implies money is more, or even equally valuable, than time. And this is a rule too many people live by. How might our perspective change when we instead start to say money is time. And when we restore time to its rightful place as the most intrinsically valuable thing we have.

Money is an idea, a collective societal agreement to store economic value. This has had tremendous impacts for our ability to trade, borrow, and build economic wealth. It has also lead to an obsession with accumulating money above all else. We have extrapolated money as not just an indicator for economic success but a proxy for unrelated areas such as happiness, health, or success in areas unrelated to business or economics. Money is simply one dimension of value, and a fulfilling life is a multi-dimensional journey of value accumulation.

How often have you heard seeking money won’t solve your problems? Yet this advice incredibly hard to follow for so many of us. What do we want money for? What it can buy us moving up an increasing hierarchy of needs: substance, travel, education, commodities, luxuries, etc. The bargain we make with ourselves is that when we have enough money stored away, we can attend to all our other needs with that wealth.

So what is it then that we really seek with more money? We want freedom of our time… the ability to buy back our time from external demands on it. To dedicate your time to what interests you most now, in the moment, and not delay until the day’s work is complete. For many in modern society, we call this retirement. Other are lucky to find ways to live it continuously, within the work they do for a paycheck, or how they view their life, retired or not.

Few realize that it’s time - the freedom to own their time - that they are truly seeking.

It is regretful that we spend so little time thinking of ourselves as rich when we are young. Yet when we value time above all else, the wealthiest that we will ever be is in our youth. But, this is true in every moment. Today you are as rich in time as you will ever be going forward. But the freedom you have with that time, will depend on the decision you make.

The time you spend doing unenjoyable things, for money, will seem a lot less necessary when you realize time is the most valuable asset you own. You can’t stop spending your time; you can only decide what to spend it on. Putting time in its rightful place, the ultimate store of value, can give you the perspective to a healthier life.

When we think of money as time, and value decisions in terms of time, it changes the calculus. If you love what you do to earn income, everything you ever buy becomes cheaper. It’s not the raw minutes of work that bought things, but it’s the opportunity cost of what you freely what have done with that time if you were not working. If your incomes source happens to be a life passion, and you’d do it for free (or far less pay), than everything you buy with that income source is that much cheaper. So while you might cringe at the cheesy advice of chasing your passions, the grain of truth is really about all the time you save by not doing work that costs you your most valuable asset without enough return.

Of course, you need some money to sustain yourself, your family, and activities you might enjoy more that don’t pay you. Very few of us are lucky enough to live a modern lifestyle for the free, even with passions that pay. Life is a complex balancing act that becomes clearer when we view our time as the primary currency. What really matters is how to do we enable a fulfilling life where I can support my needs (and my family’s needs) comfortably, but also spend my time wisely.

Let’s take a simple, concrete example. We are familiar with the exponential growth of money and how much more we can accumulate by saving early. Let’s flip that example and look at how much sooner you can retire by delaying spending.

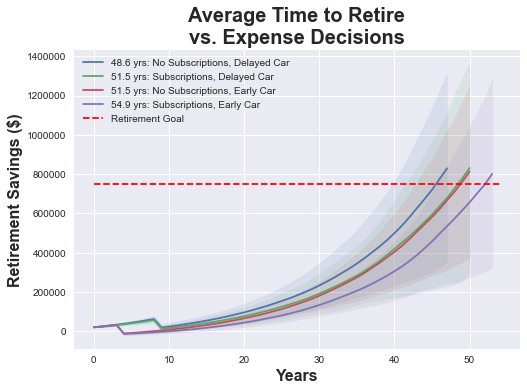

Let’s assume you have an extra $800 dollars per year of subscriptions and service that you can cancel or keep. Also, you can also put a 50K payment on a new car early (in 3 years), or delayed (in 8 yrs). Now assume you need 750k to retire, and we can look at the impact of these two reasonable examples of spending decisions of how quickly we get back our time:

Choosing to keep the subscriptions or deciding to buy the car early both delay retirement by almost 3 years. Doing both will cost you 6 years of your precious time!

A reminder though, that if you are doing what you love for a paycheck or have good work/life balance, this type of calculation is far less meaningful. Of course, accounting in terms of time is not realistic. But this is just one simple way in which viewing our time and money decisions from a “money is time” perspective can help us reprioritize. We make countless decisions on how to spend money, but we don’t realize we are implicitly making decision on how to spend our time. Make sure you know what you value more.

“Time is money” gets at the right idea, that we should view costs on many dimensions, not purely the financial value. The phrase is meant to highlight the value of your time. “Money is time” implies time is a deeper, more meaningful store of value. What we should value most is our time, and we should view money as the economic tool it is to help us spend our time in wiser ways. The more we start thinking of time as the reserve store of value on a personal level, the easier it becomes to reach the goals a fulfilling life requires. Ultimately, time is time, and there is nothing that can replace our most precious resource. I leave you with a quote from the great Thoreau, who said it better than I ever could:

“The cost of a thing is the amount of what i will call life which is required to be exchanged for it, immediately or in the long run.” - Thoreau

Sources that got me thinking about this :

- The Tail End - Tim Urban

- The Monk and the Riddle - Randy Kamisar

- Almanac of Naval - Eric Jorgenson